Prediction Market Dictionary

This page is an attempt to catalog and define the rapidly evolving vernacular used in prediction markets such as Kalshi and Polymarket. Readers on desktop can use the table of contents on the left for ease of navigation.

If you appreciate this resource, kindly subscribe to this Substack. To submit suggestions or corrections, please use the comment section below.

For more valuable information, consult: Kalshi Mention Market Dispute Bible

The following is offered for informational purposes only. It is not financial or legal advice, and it is offered with no warranties whatsoever, particularly with regards to accuracy.

Last updated: 1-27-26

alpha (n.)

1. an advantage or edge a trader may possess over others. Derived from the investment term.

2. particular information, generally not known to others, that conveys such an advantage.

arb (n.)

arbitrage (n.)

1. from finance, the simultaneous purchase and sale of an identical or substantially similar asset across two different markets, where the difference in price guarantees a profit. For example, if shares of Donald Trump to win the Presidential election are trading at $.60 on Kalshi and $.50 on Polymarket, one can purchase Yes shares at $.50 on Polymarket and purchase No shares at $.40 on Kalshi, thereby guaranteeing a profit of $.10 per share no matter the outcome of the election. A financial term.

2. (v.) engage in such a trade. E.g., “I made $100 arbitraging the election.”

bankroll (n.)

the sum of capital in a trader’s accounts. Synonymous with “port.” From finance and, later, gambling.

black swan (n.)

an extremely rare and unpredictable event. From finance and risk management; originally a Latin expression about an impossible bird.

bond (n.)

1. a contract where the underlying condition has been unequivocally and unambiguously met, and therefore resolution either to Yes or No is virtually certain.

2. (hyperbole) playing on sense (1), an outcome one is highly confident in; a sure thing. E.g., “Trump saying ‘Greenland’ during his interview tomorrow night is a bond.”

3. (v.) purchase all available contracts on the order book because of the apparent certainty of an outcome. E.g., “I bonded ‘Yes’ because I heard Trump say ‘Greenland’ in the interview.” See also: clear, wipe.

4. (v.) place maximally high bids (e.g., $.99 or higher) in a market because the outcome is considered certain. e.g., “I’m bonding ‘Yes’ on the ‘Greenland’ strike.” Frequently done simultaneously with (3). Bonding is effectively a 1-100 bet, where a trader adopts the highest possible risk for the lowest possible payout. See also: misbond, unbonded.

5. (v.) consider a market a bond, in the sense of (1).

bonded (adj.)

(of a market) treated by traders as having a certain outcome; having been bonded, as "bond" sense (4). A bonded market is usually one where the only bids that remain are on one side of the order book and at $.99 or higher. E.g., "The 'Greenland' strike is bonded." See also: bond, misbond, unbonded.

clear (v.)

1. purchase all available contracts on one side of the order book. C.f. bond, sense (3). Synonym: wipe.

2. remove all resting orders on the order book of a particular market, often done by exchanges concurrently with a major rule change or clarification.

collateral return (n.)

a mechanism on Kalshi that can optionally be enabled by traders where, in markets containing mutually exclusive strikes where only one strike can resolve Yes (e.g., “Who will win the Presidential election?”), a trader who holds “No” positions on several strikes may see part of the total cost of their contracts credited to their account. Further explanation.

cook (v.)

1. perform exceptionally, often unexpectedly. E.g., “She really cooked in the impeachment market.” Opp. cooked.

2. (of a trade) be highly profitable. E.g., “That impeachment trade cooked.”

3. cause to suffer a loss. E.g., “The impeachment market cooked me.” C.f. cooked.

cooked (adj.)

Having suffered a severe loss, as in cook sense (3). E.g., “I got cooked from my losses in the impeachment market.”

cope (n.)

1. delusional, fanciful, and/or incorrect commentary or analysis from a trader attempting to justify a position that has lost value. Also copium. From online slang.

2. (v) engage in such analysis, generally due to denial

copium (n.)

see cope, sense (1)

counterparty (n.)

the party involved on the opposite side of a trade or transaction — i.e., the buyer to a seller, or the seller to a buyer. In a less literal sense, this term can also refer generally to one who holds shares on the other side of a particular contract — i.e., another trader wagering on the opposite outcome as oneself.

cuck (n.)

see rulescuck

cuck (v.)

cause to lose a trade due to a rulescuck

degen (n.)

a trader who impulsively engages in high-risk, high-return trades, often with little to no research; also, one who is addicted to the thrill of trading. Short for degenerate, from crypto and day trading.

eat (v.)

purchase, as a particular lot of shares. E.g., “I ate those 500 shares without thinking twice.”

EV (n.)

expected value (n.)

the anticipated average value of a contract or trade. For example, if a contract has a 33% chance of resolving to Yes, and this contract is worth $1 if it resolves to Yes, the contract has an expected value of $.33. Abbreviated EV.

farm (v.)

1. take advantage of an apparently mispriced market through trading over time. E.g., “I spent the last week farming the Best Picture market because I know for sure which film is going to win the Oscar.”

2. profitably sell contracts in a market where the outcome is truly certain, usually at a high price. See also: bond, sense (4).

3. (n.) a market that is traded in this fashion

fastclick (v.)

purchase shares quickly, especially on a live market

fat finger (v.)

1. make a technical error while executing a trade (e.g., clicking “buy” when one meant to click “sell”), usually incurring a loss. Originally a 90s computing term that evolved into day trading slang.

2. (n.) such an error.

fill (v.)

1. purchase another trader’s contracts. E.g., “I filled him at $.75.”

2. (n.) a purchase, as of contracts listed on the order book. E.g., “I posted 100 shares at $.50, but I can’t get any fills.”

fish (n.)

an unskilled trader, considered to be vulnerable “prey” to more experienced ones. Originally a poker term. C.f. whale.

fud (n.)

1. derogatory information meant to manipulate market prices downward. Also rendered “FUD.” Short for “fear, uncertainty, and doubt,” a term originally from mid-20th century business and finance.

2. (v.) spread such information

full port (v.)

(often humorous) commit one’s entire portfolio, esp. into a single trade. From day trading and crypto trading. See also: port.

goated (adj.)

extremely successful and proficient, particularly recently. From “GOAT,” an abbreviation of “greatest of all time,” ultimately sports slang.

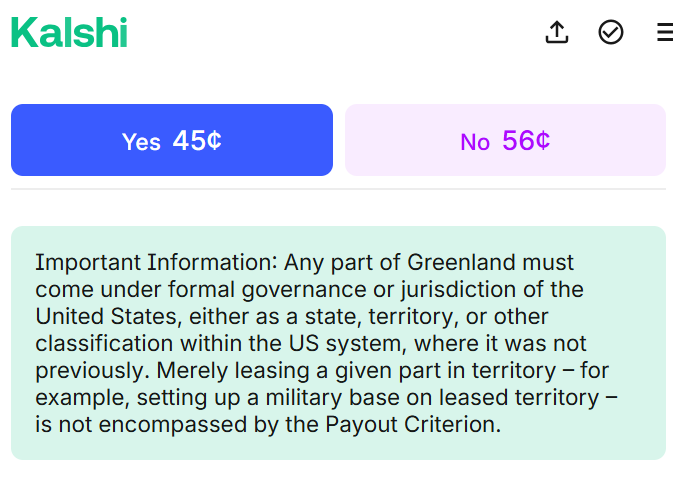

Green Box (n.)

1. on Kalshi, a determination, rule clarification, contractual adjustment, or other such consequential new information appended to a live market. So called because of the background color it appears in. For example:

2. (v.) affect a market through publishing a Green Box. E.g., “The Super Bowl market was Green Boxed.”

hit (v.)

1. (mention markets) (of a strike) be said by a speaker. E.g, “‘Autopen’ hit during the Trump’s speech.”

2. (mention markets) (of a speaker) say a particular strike. E.g., “Trump hit ‘autopen’ during his speech.”

Ideas (n.)

1. the comment section on Kalshi market pages

2. (mildly derogatory) collectively, the traders who post in this comment section, who are largely considered to be unsophisticated

3. (adj.) (often humorous) (of a comment or post) incorrect, of low quality, and/or delusional; akin to the sort of information that can often be found in Kalshi comment sections

insidered (adj.)

1. (often humorous) (of a particular market or underlying event) manipulated by one or more insiders, generally producing an unxpected outcome. E.g., “Trump’s State of the Union address was insidered by Barron, who told his dad to say ‘Crypto.’”

2. (often humorous) (of a trader) having lost in a market due to such insider manipulation. E.g., “I was insidered on Trump’s State of the Union address.”

kyc (n.)

know your customer. a standard or process where an exchange must verify the identity of a user.

limit order (n.)

a type of order where the price and quantity of contracts are specified. An expiration time may also be specified. Limit orders may be filled instantly if there is a counterparty for the specified price, else they may rest on the order book until purchase or expiration. Further explanation. C.f. market order.

liquidity (n.)

1. referring to a market, a measure of how easily one can purchase contracts based on their availability on the order book. E.g., “I want to buy shares of Taylor Swift to win a Grammy, but I cannot because the market has low liquidity.” From the finance term.

2. A trader’s available cash. E.g., “I want to buy these contracts, but I don’t have enough liquidity.”

livetrade (v.)

buy and sell contracts during an event, especially in mention markets. As opposed to only making trades prior to an event. A prediction market neologism.

lock (n.)

a trade guaranteed to profit; a sure thing. C.f bond sense (2).

locked in (adj.)

extremely focused. From Zoomer slang

lot (n.)

a block of contracts available on the order book. E.g., “She placed a bid for a lot of 500 Yes shares at $.10.” From stock trading.

lotto (n.)

a long-shot contract purchased at a low price and having a low probability of paying out, where winning would be extremely profitable. E.g., a 50-1 bet.

maker (n.)

1. a type of trade where contracts are listed on the order book, making them available for purchase. On Kalshi, maker trades incur no fees for the person listing the contracts, except in certain markets. Further explanation. Antonym: taker.

2. one executing such a trade

market maker (n.)

a large investor — usually an institution such as a trading firm — contracted to provide liquidity on a market. Further explanation.

market order (n.)

a type of order where a dollar amount is specified, but not the price or quantity of contracts. Market orders are executed instantly (provided there are contracts available on the other side of the order) and always incur fees on Kalshi. It is generally inadvisable to execute market orders. Further explanation. C.f. limit order.

misbond (v.)

1. erroneously bond a market, as bond senses (3) and (4). This normally incurs a large and unpleasant loss. E.g., “I misbonded ‘Greenland’ in the mention market, because Trump actually said ‘Greek land.’” See also: bond, unbonded.

2. (of a market) having been misbonded, as sense (1).

3. (n.) a market erroneously considered a bond, as bond sense (1).

mismog (v.)

1. purchase a large amount of contracts or all available contracts (i.e., “mog,” senses (1) and (2)) based on a presumption that turns out to be incorrect. In other words, an error. E.g., “I mismogged Y in the Hegseth resignation market because I read a fake news article saying he resigned.” See also: mog.

2. (n.) such a purchase, or a market where such a purchase has occurred

misres (n.)

1. a market that is incorrectly determined. Short for “misresolve.” A prediction market neologism

2. the incorrect determination of a market

3. (v) incorrectly determine a market.

mog (v.)

1. purchase a large amount of contracts, often causing a major price movement. From “AMOG,” incel slang. See also: mismog.

2. purchase all available contracts on one side of a market. E.g, “she mogged the order book.” See also: bond sense (3).

3. purchase a particular lot of shares, often a large one. E.g., “he mogged those 10,000 shares.”

4. (less commonly) dominate or outplay another trader. E.g., “we were mogged by that whale.”

moon (v.)

increase in value, usually by several multiples. E.g., “my shares of Zohran winning the election mooned after the debate.” From stock trading and crypto trading.

N (n.)

the “No” outcome of a prediction market contract, where the contract’s value resolves to 0.

N fest (n.)

(mention markets) a mention market in which few strikes hit. E.g., “Vance’s speech last night was a N fest — he spoke for less than two minutes.” Antonym: Y fest. A prediction market neologism.

N gang (n.)

(mention markets) (humorous) traders largely buying No contracts for several strikes in a certain event — perhaps expecting a N fest. Antonym: Y gang. A prediction market neologism.

parlay (n.)

a particular trade that combines two or more potential outcomes, generally with a low probability of success and a high return if successful

pennyjump (v.)

place a bid that is exactly 1 cent higher than the next highest bid on the book (or .1 cent higher, in fractional markets). Derived: “pennyjumper” (n.), one who engages in this practice. From stock trading.

port (n.)

short for “portfolio,” the total amount in a trader’s account. Generally considered to include both liquid cash and contracts held.

print (v.)

1. profit greatly, i.e., “print money.”

2. (of a trade or market) create a large amount of profit. E.g., “My Bad Bunny shares are printing.”

rinse (v.)

cause to lose a large sum of money. E.g., “I got rinsed in the weather markets last week.”

roll (n.)

rug (n.)

1. (mention markets) a market where the underlying event is unexpectedly cancelled, nonpublic, brief, or otherwise not conducted as anticipated. E.g., “That Trump mention market was a rug -- he didn’t say a word, so every strike resolved No.” Short for “rug pull.” From crypto, adopted from an earlier 20th century expression involving literally pulling the rug out from underneath someone.

2. a market resolution that is perceived as unexpected and/or unfair, often based on a technicality. C.f. rulescuck.

3. (v.) (mention markets) cause such a market occurrence, as in sense (1). E.g., “Trump rugged us last night when he didn’t show up to his own press conference.”

4. (v.) (mention markets) (of an exchange or exchange employee) cause or be responsible for such a market occurrence, as in senses (1) and (2). E.g., “ Kalshi rugged us last night.”

rugpull (n.)

see rug

Rule 7.1 (n.)

per the Kalshi Rulebook, a rule that permits Kalshi to review the final outcome of a contract at its sole discretion, particularly where there is a question as to the reliability of the Underlying.

Rule 7.2 (n.)

per the Kalshi Rulebook, a rule that permits Kalshi to designate a new Source Agency or Underlying for a contract due to a circumstance that may call into question the reliability of the current Source Agency or Underlying. this rule also permits Kalshi to modify the Expiration Date of a contract.

rulescuck (n.)

1. a technicality involving the underlying contract rules where a market may resolve in an unintuitive, disputable, and/or controversial way. From the erotic term “cuckold.”

2. (mildly derogatory) a trader who argues for such a contrarian resolution; also, a trader who actively seeks out such situations to profit off them

3. (v.) cause to lose a trade due to such a technicality. E.g., “I thought I had won, but then I got rulescucked.”

scam app (interj.)

(humorous) used to complain, usually ironically. From a common complaint made by aggrieved traders, often on Kalshi in Ideas. A prediction market neologism.

sharp (n.)

a proficient, experienced trader. From “card sharp,” a gambling term.

slam (v.)

1. purchase contracts on a particular side of a trade, as with vigor and conviction. Evocative of “slamming” the order button.

2. purchase a specific lot of contracts, as with intensity. E.g., “Someone slammed those 5,000 shares on the order book.”

3. indicate that one has conviction about a particular side of a trade. E.g., “I’m slamming ‘Yes’ on the ‘Will the Knicks beat the Celtics?’ market.”

snipe (v.)

quickly purchase, as a particular lot of contracts or a quantity of contracts up to a certain price point. From an 18th-century hunting term.

source agency (n.)

also Source Agency. Per the Kalshi rulebook, “the agency that publishes the Underlying and/or Expiration Value for any Contract” — in other words, the final authority that determines how a contract will be decided. A contract may have several source agencies listed hierarchically; in case of conflicting information, higher-ranked agencies will take precedence over lower-ranked agencies.

spread (n.)

the difference between the highest bid price and the lowest ask price on an order book. From stock trading.

strike (n.)

1. in a market featuring several possible outcomes, dates, or other such listings, any individual listing can be considered a “strike.” E.g., a market for “Who will Trump meet in February?” can contain strikes such as “Xi Jinping,” “Vladimir Putin,” etc.; a market for “What will the price of Bitcoin be on midnight Friday?” can contain strikes such as “$100,000,” $200,000,” etc.; and a market for “When will France hold an election?” can contain strikes such as “before April,” “before December,” etc. Strikes may or may not be mutually exclusive. Individual strikes may also be referred to as “markets.”

2. (mention markets) a particular word or phrase that can be traded. E.g., “Bernie hit the ‘working class’ strike at his rally last Saturday.”

stink bid (n.)

an extremely low bid placed near the bottom of the order book — usually far below bids closer to the market price — in the hopes of getting fills due to the incompetence of other traders, volatile price swings, misbonds, or the removal of higher trades from the book. Stink bids can occasionally be filled when counterparties make market orders. From stock trading.

sweat (v.)

1. hold a position for a period of time while it is uncertain and/or risky to do so. E.g., “I sweated my N bet on Trump saying ‘Autopen’ during the State of the Union.” From gambling. C.f. sweaty

2. monitor a position in such a fashion

sweaty (adj.)

(of a position) held while it is uncertain and/or risky to do so

swing (n.)

a movement in the price of a contract, particularly a large or sudden one. C.f. swing trade

swing trade (v.)

1. trade contracts in a market taking advantage of high price volatility. C.f swing

2. (n.) such a trade

tail (v.)

follow or copy another trader in a trade. E.g., “I tailed her on her election trade, even though I don’t know anything about politics.”

taker (n.)

1. a type of trade where contracts listed on the order book are purchased. On Kalshi, taker trades incur fees for the purchaser, but not for the person who listed the contracts. Further explanation. Antonym: maker.

2. one executing such a trade.

thesis (n.)

the rationale behind a trade, prediction, trading plan, or trading strategy.

theta (n.)

theta decay, the decrease in the value of a contract as time passes. For example, shares of Yes in "Will Trump resign in 2026?" will inherently lose value as each day passes, approaching the end date of the contract. From options trading.

thin (adj.)

1. (of an order book) having few shares available for purchase, often where the purchase of a small quantity of shares can significantly alter the market price.

2. marginally profitable, as in thin value. A poker term.

trap (n.)

a strike, market, or contract that is devised in such a way where the obvious or intuitive outcome is in fact the less likely outcome. Frequently used in mention markets. E.g., “’Yuge’ is a trap in the Trump State of the Union market -- he hasn’t said that in years.” also “trap strike.”

trap strike (n.)

(mention markets) a trap.

UMA (n.)

short for Universal Market Access, the decentralized system that handles market resolution for Polymarket international.

unbonded (adj.)

a market that was for a time bonded, but is no longer so. Often the result of a misbond, sense (2). See also: bond, bonded, misbond.

underlying (n.)

also Underlying. Per the Kalshi rulebook, “the index, rate, risk, measure, instrument, differential, indicator, value, contingency, occurrence, or extent of an occurrence the Expiration Value of which determines whether a Contract is in-the-money.” In other words, what a contract is essentially about. Further explanation.

vibe-trade (v.)

(often humorous) trade based on instinct and/or emotion, often impetuously. C.f.: vibes

vibes (n.)

(uncountable) (often humorous) rationale for a trade that is perhaps emotional, instinctual, and/or frivolous. E.g., “I bought Kamala Harris to win the election because vibes.” See also: vibe-trade. From Boomer slang popularized by the Beach Boys.

volume (n.)

1. the total quantity of contracts traded in a given market.

2. a quantity of contracts being traded, especially a large one. E.g., “I’m doing a lot of volume in the Golden Globes market.”

3. a measure of the availability of shares on the order book of a given market. C.f. liquidity

wall (n.)

a large bid on the order book, especially one that sets a price floor. E.g., “I wonder who put up that wall of 50,000 shares.”

weave (v.)

1. (mentions markets) (of a speaker) avoid, often conspicuously, using a certain term. E.g., “Trump weaved saying ‘tariff’ despite talking about trade deals for 10 minutes.” Originally a political neologism formed around Donald Trump.

2. (n.) such an evasion.

whale (n.)

a successful trader who moves a large amount of volume and trades with a large (generally six figures or higher) bankroll. Originally a gambling term. C.f. fish.

wipe (v.)

see clear

Y (n.)

the “Yes” outcome of a prediction market contract, where the contract’s value resolves to $1

Y fest (n.)

(mention markets) a mention market in which most strikes hit; often, a yap. E.g., “Vance’s speech last night was a Y fest — he went on for two hours.” Antonym: N fest. A prediction market neologism.

Y gang (n.)

(mention markets) (humorous) traders largely buying Yes contracts for several strikes in a certain event, perhaps expecting a yap or Y fest. Antonym: N gang. A prediction market neologism.

yap (v.)

1. (mention markets) (of a speaker) speak at length, potentially hitting several strikes in a market.

2. (n.) an event where a speaker speaks at length in this fashion. E.g., “Trump’s speech yesterday was a yap.” Also yapfest. From Zoomer slang.

yapfest (n.)

yap (sense 2)

yolo (v.)

1. (often humorous) make an impulsive trade, particularly one that is reckless and relatively large. From day trading and crypto trading, derived from Millennial slang.

2. impulsively commit a large sum to a trade. E.g., “I just yoloed half my portfolio into Kamala winning the election.”

Great resource and good write up

fastclick: purchase shares quickly, especially on a live market

Definition can be improved. Something to this effect, can be re-worded.

Quickly purchasing shares that are available for far cheaper than fair market value, usually by being first to capitalize on market-moving news or updates